With the release of the January 2025 Data Wave, it is evident that European Travellers continue to evolve in their preferences, priorities, and behaviours. This year, we have observed key changes shaping the travel industry, from a growing interest in private accommodations to the increasing popularity of small and unique towns. In this article, you will find the top year-over-year (YoY) trends based on insights from our latest data wave.

Key Insights from the January 2025 Data Wave

1- Family and Friends Dominate Inspiration Sources

Family and Friends remain the top source of inspiration for European Travellers, with 62.6% relying on personal recommendations. However, online sources also play a crucial role. Search Engines like Google and Bing influence 50.7% of travellers, while Online Review Sites such as TripAdvisor hold significant weight at 39.6%. These insights highlight the balance between personal connections and digital resources in travel planning.

2- Private Accommodations Are Gaining Popularity

While 3-4* Hotels continue to lead the accommodation ranking with 50%, Private Rentals are on the rise, securing the second spot at 35.1%, reflecting a 6.7 pp increase from last year. Additionally, the preference for "having my own private home at the destination" grew by 4.1 pp. This trend underscores a growing demand for more private and personalized stays over traditional hotel experiences.

3- Small and Unique Towns Drive Travel Decisions

Travellers are increasingly drawn to smaller, authentic destinations. "Small and Unique Towns" now lead travel preferences at 56.6%, surpassing more traditional choices. "Going to the Beach" follows closely at 53.3%, while "Cultural & Historical Experiences" rank third at 53%. This shift suggests a growing interest in destinations that offer authenticity, heritage, and a slower pace of travel.

4- Cleanliness Is Key for European Travellers

Safety remains the top priority for European Travellers, with 68.9% valuing "Safety Standards" as a crucial factor. "General Cleanliness" follows closely at 68.4%, while "Health and Hygiene Standards" are essential for 65.7% of travellers. "Affordability" is also a key consideration, ranking at 63.2%, indicating continued budget consciousness. However, accessibility to "direct flights" has seen an 8.4 pp decrease from last year, signaling a shift in priorities when selecting destinations.

5- Active and Adventure Holidays Gain Importance

While "Sun and Beach holidays" and "Relaxing Getaways" remain dominant choices, there is a notable rise in active travel preferences. "Mountain and Wilderness Holidays" and "Hiking/Trekking" have each seen a 7 pp increase compared to last year. This growing demand for outdoor and adventure experiences highlights an interest in healthier and nature-focused travel.

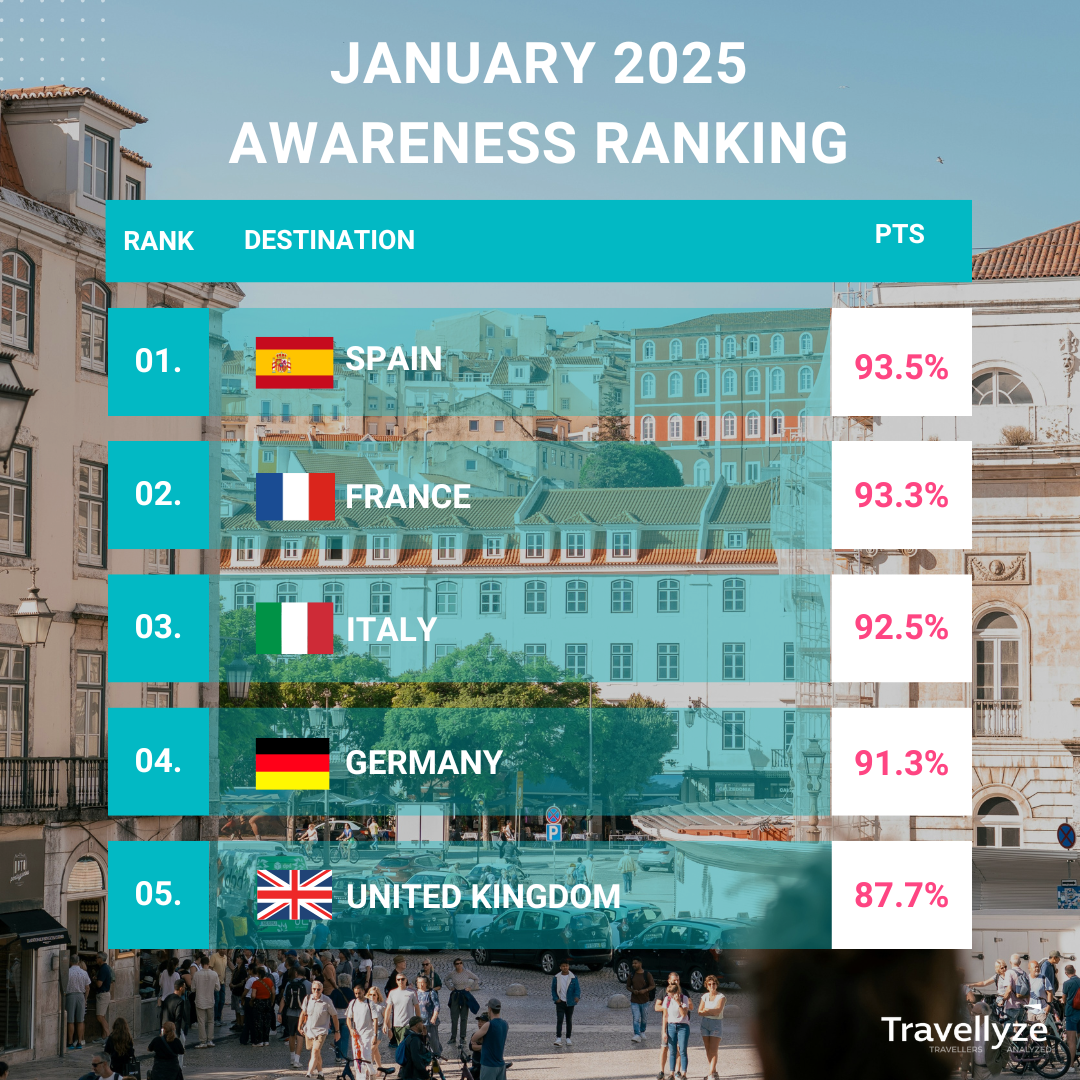

6- Awareness Ranking

The Awareness Ranking measures how well a destination is recognized by travellers in a specific market. It reflects the percentage of respondents who are familiar with a destination

7- Appeal Ranking

The Appeal Score reflects travellers’ desire to visit destinations, both in the short term (next three years) and long term.

The January 2025 Data Wave provides valuable insights for the travel industry, helping businesses and destinations adapt to evolving traveller preferences. From accommodation trends to the appeal of small towns, these findings can guide your strategy to better cater to European travellers' expectations.

Interested in exploring more? Create your free account on Travellyze today and stay updated with the latest travel trends. Also, don’t forget to follow us on LinkedIn for regular data insights and trends!