Exploring the travel dynamics of the Italian demographic yields valuable data for DMOs, agencies, and tourism professionals. This article, powered by Travellyze data, explores pivotal aspects of the Italian traveller, providing insights that can shape your destination marketing strategy. Let’s jump in!

General Demographics Analysis

In the case of Italian travellers, the predominant age group is 55-64 years, constituting a substantial 26% of the sample. As for the top education level, vocational education constitutes 38.8% of the sample, over 62% of the Italian travellers report being cohabiting or married, and 53% of them don’t have children.

Household Income and Travel Budget of the Italian Traveller

Over the past year, we've observed notable shifts in household income among Italian travellers, offering insights into their evolving financial dynamics.

The household income for Italian travellers is up, specifically, the "18,000 - 35,999 Euros" group has seen a solid 4-point increase, showing a stronger financial position for many travellers. The "36,000 to 58,999 Euros" group is doing well with a 3.7-point growth. However, the "59,000 to 85,999 Euros" category is down by 0.9 points.

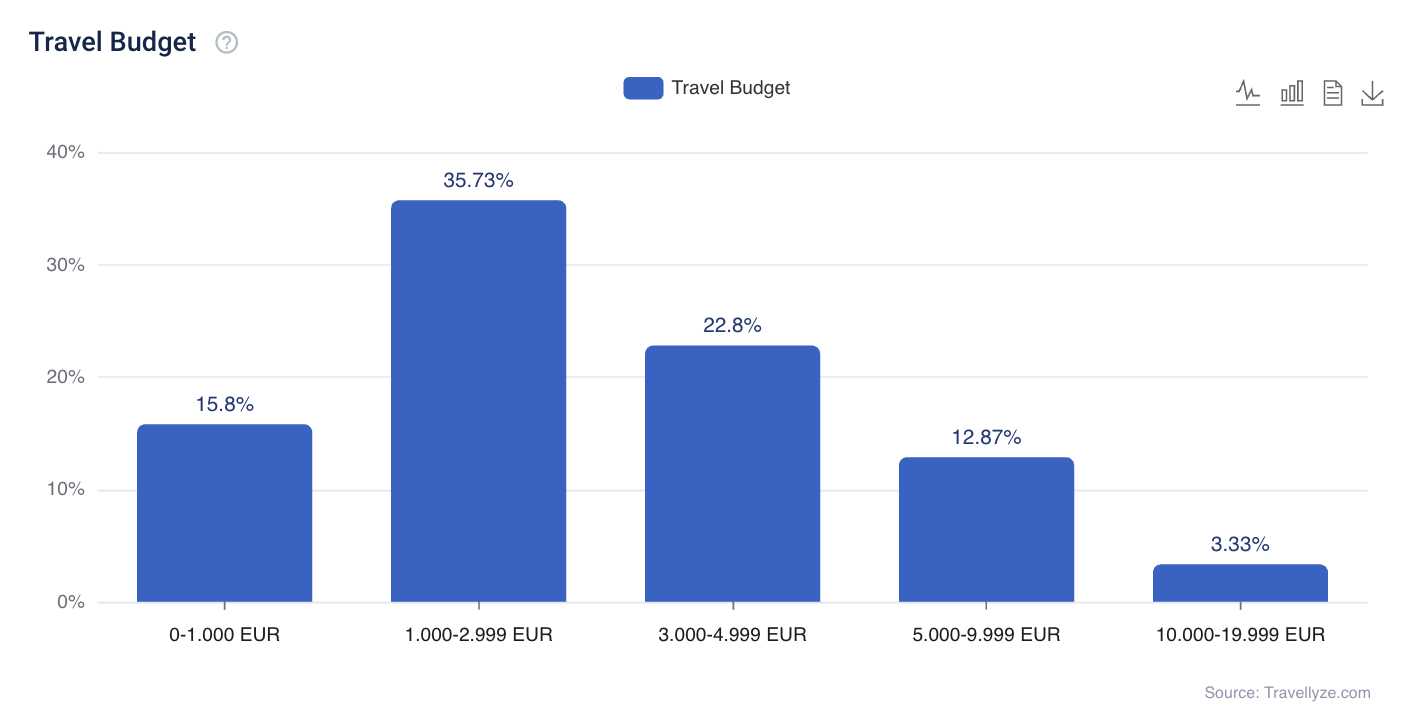

As for travel budgets, we notice a significant 17.2-point drop in the "Under 1000 Euros" category, suggesting many travellers have moved beyond lower incomes. We also noticed a 10-point growth in the "3,000 to 4,999 Euros" group, indicating a growing middle-income group.

“The data relating to the average spending of Italians gives us hope, as it suggests a propensity to travel supported by greater economic capacity. Also interesting is the trend which sees Italians solicited equally by relatives and friends and by search engines; a constant over the years, although growing in percentage terms, even now 53%. Overall, the research reconfirms Italians' attitude to travel in its contents, catalysts but also destinations, with an interest in the Bel Paese that significantly stands out from any other destination. It's nice to be able to start traveling abroad again, but we always love the domestic dimension of holidays!” - Serena Valle, CEO Interface Tourism Italy

Top Inspiration Sources for the Italian Traveller

Our survey reveals the leading sources of travel inspiration for Italian travellers in 2024 are:

- Search Engines, like Google and Bing (53% of respondents)

- Friends and Family (53% of respondents)

- Online review sites, like Tripadvisor (50,67% of the respondents)

- Instagram (35,67% of respondents)

- Travel TV programmes (35,4% of respondents)

The influence of search engines like Google and Bing stands out, reflecting an active and pragmatic approach to travel planning. Additionally, the impact of recommendations from friends and family highlights the significance of personal connections in travel decisions. Online review platforms like Tripadvisor complete the Top 3 ranking, showing the strength and relevance of social proof. As for social media, Instagram is the sole representative in this ranking, a testimony to its unique visual appeal and popularity. Our Top 5 ranking of inspiration sources shows a majority of online channels, reinforcing the importance of having a solid digital presence and strategy.

Travel Catalyst and Enablers

Understanding the factors that drive and facilitate travel is crucial for destination marketers. In this context, Travellyze offers two concepts that play a pivotal role: Travel Catalysts and Enablers.

Travel Catalysts are the factors that ignite a traveller's interest and inspire them to explore new destinations. On the other hand, Travel Enablers are the conditions that make the travel experience smoother and more enjoyable.

Here are the Top 5 Travel Catalysts and Enablers for Italian Travellers in 2024:

For Italians, the allure of small and unique towns tops the list, with a substantial 65.48% expressing a strong inclination towards such destinations. Following closely, cultural and historical experiences play a pivotal role, capturing the interest of 62.58% of respondents. Emphasizing these aspects in promotional materials can significantly attract Italian travellers.

As for Travel Enablers, focusing on general cleanliness proves paramount, as an overwhelming 74.49% consider it a critical enabler. Safety standards and low crime rates closely follow, influencing 73.13% of respondents in their travel decisions. To cater to Italian travellers, destinations should prioritize maintaining high cleanliness standards and emphasizing safety, thus aligning with the preferences of the majority.

How does the Italian Traveller behave when travelling?

When it comes to booking, a significant 51.53% of respondents express a preference for the flexibility of separate bookings through price comparison sites. This trend holds for both domestic and international European trips. However, when Italian travellers venture outside Europe, they prefer packaged deals encompassing both flight and accommodation.

In the realm of accommodation, the majority (58.87%), opt for staying in 3 or 4-star hotels. Following closely, B&B establishments capture the preference of 45.13% of respondents. Notably, Holiday Homes secured a solid third place, selected by 29.2% of travellers.

"Sun and beach holidays" is the holiday type chosen by Italian travellers, dominating 75.33% of responses. Following closely, visit "big city holidays" securing the second spot at 53.8%. Rounding up the top three is the desire for tranquility, with 50.4% opting for a relaxing getaway.

Top 5 Destinations for Italian Travellers

Our Image Ranking algorithm incorporates dimensions of perception, experience, and awareness to produce a single and easy-to-understand metric.

Here’s the ranking for Italian Travellers:

We find it important to note whether these destinations increased, remained stable, or decreased compared to the previous year (January 2023), and that's precisely what the arrows on the side of the image indicate.

Ready for more insights about different traveller markets? You can check out our analysis of the Spanish Traveller and connect with us on LinkedIn to stay updated on the latest data. Follow us here.