How do tourists from the LGBTQ+ community travel and how do they plan their trips?

LGBTQ+ tourism is a key segment for the recovery of the tourism sector after the pandemic. These travelers are essential in achieving diversity. According to the latest data provided by the World Tourism Organization, this segment is the one with the highest growth rate.

The analysis of LGBTQ+ travelers is very significant for the new strategies that companies in the sector must adopt. Thanks to the recent update of Travellyze data, we can identify the main trends and characteristics of this segment.

Read on to find out the 5 keys to the LGBTQ+ tourist.

Market Research of the LGBTQ+ travel community

Who is a traveler from the LGBTQ+ community?

The first step to understanding any tourist segment is to analyze its demographic characteristics. Thanks to the personalization of searches on Travellyze, we can see that the LGBTQ+ tourist represents 6,8% of the European adult population. This interesting data reaffirms the importance of this target.

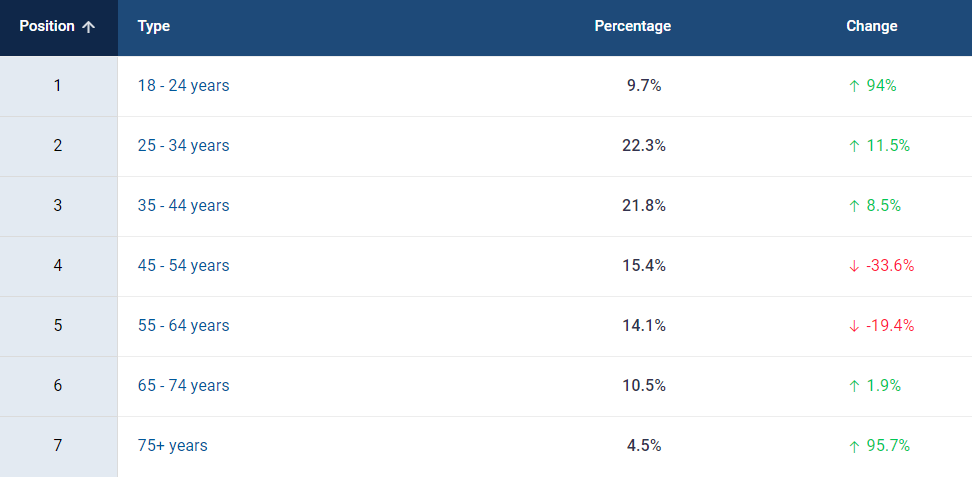

According to this first demographic analysis, we can also see that the age of this traveler profile is concentrated between 25 and 44 years old. Although, when using the comparison tool by year, we observe that the age range that has grown the most since 2021 is 75+ years old.

Within this analysis it is also possible to identify the marital status and education that characterize the European LGBTQ+ tourist. As can be seen in the graph below,just under half live together/married, or are single.

How much do LGBTQ+ travelers earn and how much do they spend on travel?

Once we know the main characteristics of this tourist profile, Travellyze provides us with the opportunity to delve deeper into their household income and travel-related expenses. This is key data that varies according to the year and the market we are investigating.

Household income

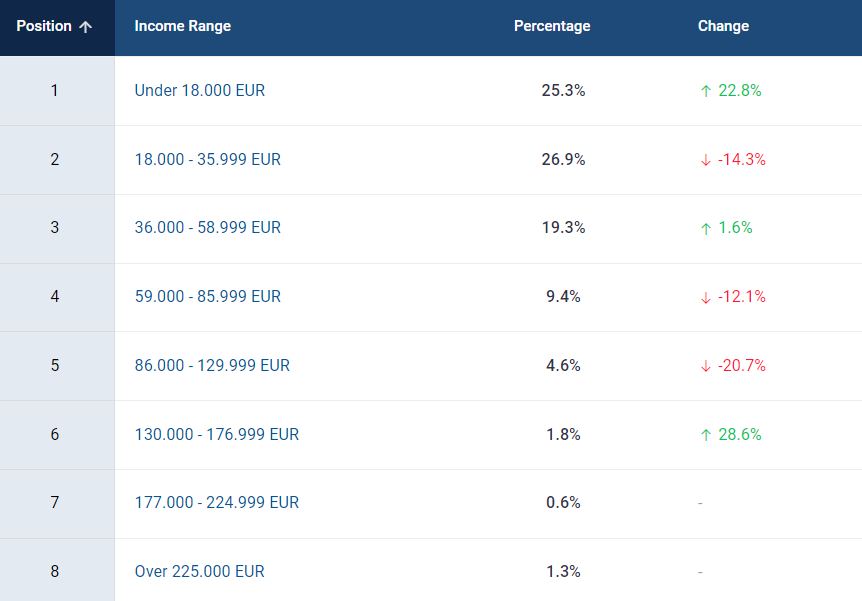

In the case of the household income of European LGBTQ+ tourists, 26.9% of them have an income between €18,000 and €35,999.

Budget planning

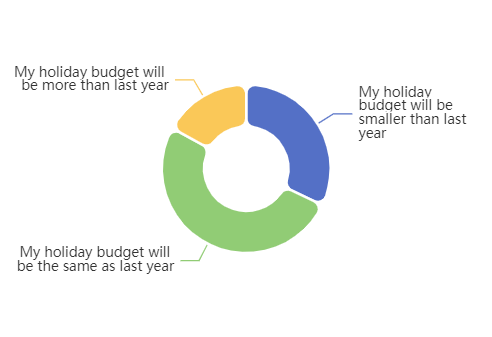

The Travellyze platform indicates the evolution of the travel budget compared to the previous year. Data evolution information can also tell us, as in this case, how events such as the pandemic have affected the budgets of tourists. As the graph below indicates, 45.2% of European LGBTQ+ tourists expect to spend the same on vacations in 2022 as they did in the past.

What sources of information influence these travelers?

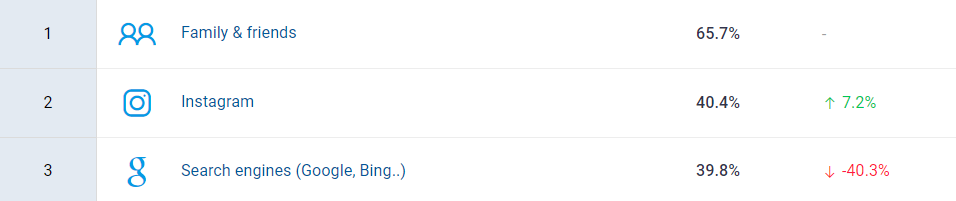

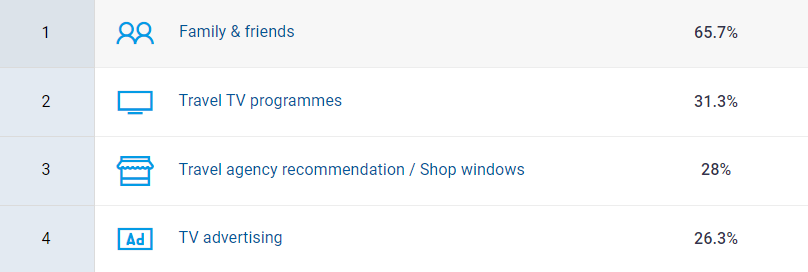

Knowing which sources influence the LGBTQ+ traveler can be very useful when creating more efficient promotional actions. According to Travellyze, the greatest source of information for this target is the opinions and experiences of their family and friends.

Although in the top 3 of the most relevant sources of inspiration, Instagram and Search Engines also stand out.

In accordance with the variety of inspirational media that exist, with Travellyze it is also possible to specify the search and focus only on online and offline media.

In the case of the offline media that most inspire European LGBTQ+ tourists are travel TV programs, travel agency recommendations and TV advertising, as well as family and friends.

What aspects of a vacation are most important to the LGBTQ + tourist?

Each tourist segment attaches greater or lesser importance to certain aspects of the destinations. Vacation aspects are crucial to the tourist's decision on which destination to travel to. This Travellyze analysis section allows travel companies to know which destination features are more or less attractive.

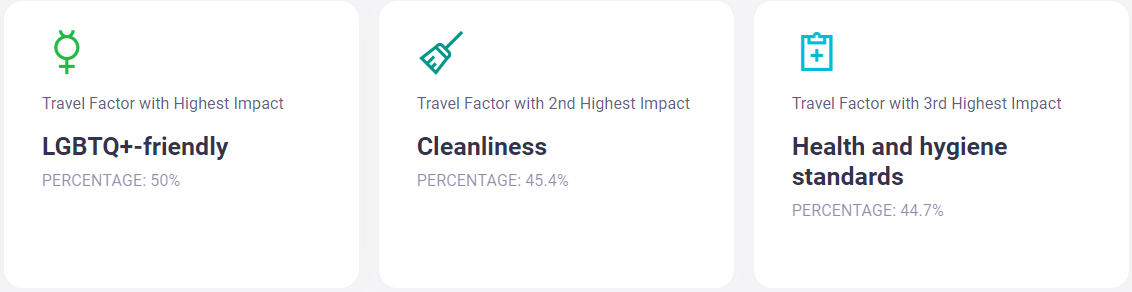

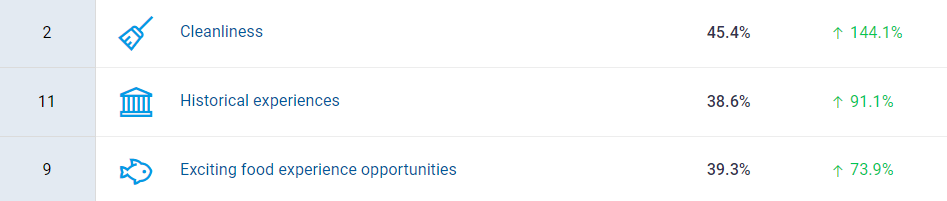

Looking at the results of the European LGBTQ+ tourists, we can affirm that, in addition to highly valuing the destination's openness to diversity, they also attach great importance to health and hygiene standards.

If we take a closer look at the ranking of travel factors we can see how the factors that have grown the most since last year are the destination's cleanliness, the historical experiences on offer and exciting food experience opportunities.

These preferences of the European target are not all the same throughout the region as those of the LGBTQ+ tourist from the Nordic countries differ from other countries, since, compared to last year, their ranking includes a greater interest in visiting theme parks as well as going to the beach. For Spanish LGBTQ+ travellers, fine dining and opportunities to go to theme parks saw the largest increases.

As part of the analysis of traveler behavior, Travellyze also allows us to know what responsible experiences the segment of tourists carry out during their vacations.

Responsible actions taken by German LGBTQ+ tourists during their vacations are mainly the choice of train transport over plane tickets, as well as taking part in a rural / local community experience to share their domestic life and supporting a social conservation project.

Although the action of traveling by train vs. traveling by plane tends to be the most common among the various LGBTQ+ markets in Europe, there are some differences depending on the market.

For example, 20% of French LGBTQ+ travellers opt to choose a train or bus over a plane ticket, the same percentage as those choosing ecofriendly accommodation despite costing more than a regular one.

What are their favorite types of vacations and accommodations?

In order to understand the type of accommodation and type of vacation preferred by LGBTQ+ tourists, it is necessary to analyze Travellyze's section on tourist behavior.

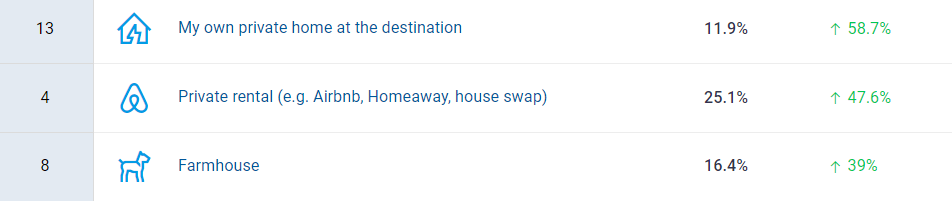

In the case of the European target, the accommodations that are increasing in popularity compared to last year are private homes at destinations, private rentals and farmhouses. This information can give us clues about the micro-trends of this segment of tourists in 2022.

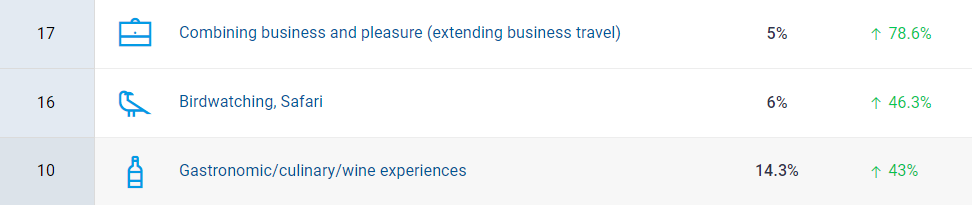

Now, what type of vacation do they prefer? Apart from the classic relaxation or sun and beach holidays, this target group of European tourists is combining business and pleasure tips the most compared to last year. Next in the ranking, Travellyze has also analyzed the growth in their interest in birdwatching/safari trips and those offering gastronomy and culinary experiences.

How do LGBTQ+ tourists rank the image of each destination?

Finally, let's look at the destination research section. In this section we can find out which destinations have a more favorable image, how the destination is perceived or how much knowledge about the destination our target has.

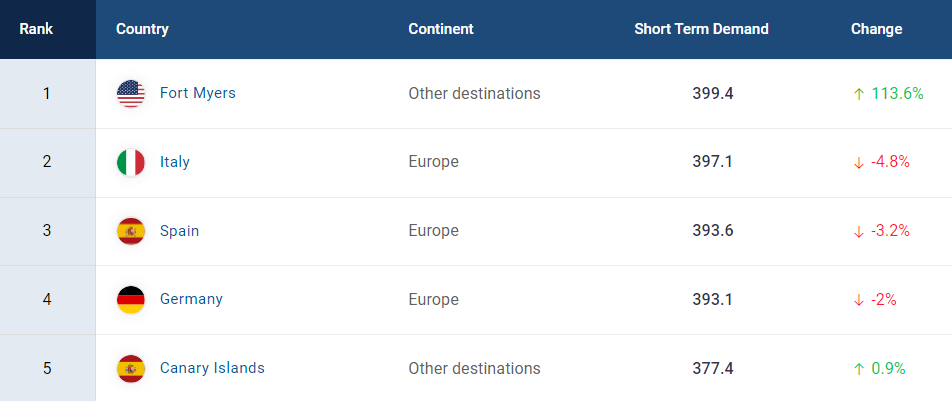

The ranking below clearly shows that the destination with the most favorable image for the European target is Fort Myers in the USA, followed by Italy, Spain, Germany and, in fifth place, the Canary Islands.

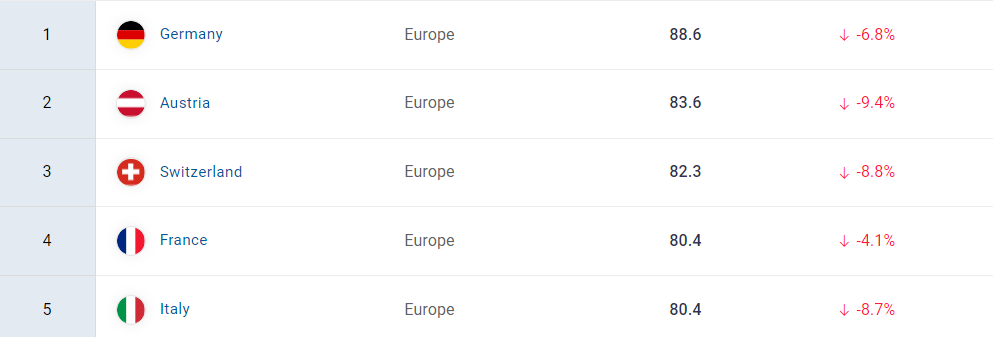

As mentioned above, it is also possible to know what level of awareness of the destinations the tourists have. An example of this is the information obtained about LGBTQ+ German tourists, who have a high knowledge of Austria's offer.

Lastly, Travellyze allows us to peek into the travel wish list of LGBTQ+ tourists with the destination appeal section. This section shows a ranking with key information about those destinations that the target has not yet visited but would like to in the near future.

To illustrate this, by customizing the searches it is possible to state that LGBTQ+ tourists from the Nordic countries who are yet to visit the destination’s greatly idealise Germany, Scotland and Switzerland.

Undoubtedly, all these characteristics make the LGBTQ+ tourist a target with a lot of potential for companies in the tourism sector.