Leveraging data-driven insights from Travellyze, we uncover the essence of Dutch travel culture and provide valuable insights for industry stakeholders seeking to engage with this dynamic market segment.

General Demographics and Budget Analysis

Dutch Travellers, known for their adventurous spirit and openness to new experiences, represent a dynamic demographic within the European travel landscape. Based on Eurostat, the age group of 25-34 years emerges as the most prominent, comprising 19% of the population. This age cohort is often characterised by individuals seeking adventure and cultural immersion, aligning well with the exploratory nature of travel.

Furthermore, Vocational Education is the primary educational background, reflecting a workforce with practical skills and a hands-on approach to life. Additionally, the prevalence of the Cohabiting/Married civil status underscores the significance of travel as a shared experience among couples and families, highlighting the importance of travel in fostering relationships and creating lasting memories.

In this segment, we see that the highest travel budget segments are: the "1,000 - 2,999 EUR" group with 28.8% of respondents; the "3,000 - 4,999 EUR" group with 27.4% of respondents; and the "5,000 - 9,999 EUR" group with 17.8% of respondents.

When asked about their holiday budgets for 2024, 56.4% of Dutch travellers reported they would maintain the same travel budget as last year. Also, 14% of them reported intentions of increasing it.

How Dutch Travellers Get Inspired

Dutch Travellers draw inspiration from a diverse array of sources, reflecting their penchant for thorough research and informed decision-making. Topping the list is the reliance on search engines like Google and Bing, showcasing the importance of online exploration in the travel planning process. This highlights Dutch travellers' proclivity for independent research, allowing them to curate personalized travel experiences tailored to their preferences.

Additionally, the influence of family and friends remains significant (57.8% of travellers), underscoring the importance of word-of-mouth recommendations and trusted advice in shaping travel decisions. In the third position, we find TripAdvisor, chosen by 45.6% of travellers. This is a significant difference with the first two sources of inspiration from the ranking but it is still a relevant channel that emphasises authenticity and transparency.

With a strong preference for online platforms and digital resources, Dutch travellers leverage various channels, including online travel agencies and travel company websites, to access comprehensive information and secure the best deals for their upcoming adventures. This inclination towards online inspiration sources aligns with the young demographic of Dutch travellers, who are tech-savvy and accustomed to utilising digital tools for trip planning and research.

These are the top 5 destinations on the Image Ranking for Dutch Travellers in 2024

Top 5 Travel Catalysts for the Dutch Traveller:

- Fine dining (81.05%): Dutch travellers prioritize exquisite dining experiences, showcasing their appreciation for culinary excellence and gastronomic adventures.

- Cultural & Historical Experiences (71.63%): The allure of cultural and historical landmarks captivates Dutch travellers, reflecting their penchant for immersing themselves in the rich heritage and traditions of destinations.

- Visiting small and unique towns (64.04%): Dutch travellers are drawn to intimate and distinctive locales, showcasing their preference for off-the-beaten-path destinations and authentic local encounters.

- Food Experiences (53.04%): Indulging in diverse culinary delights is a key aspect of Dutch travel preferences, highlighting their eagerness to savour local flavours and gastronomic delights.

- Shopping (52.74%): Dutch travellers enjoy exploring vibrant markets and boutiques, emphasizing their interest in discovering unique souvenirs and locally crafted goods.

Top 5 Travel Enablers for the Dutch Traveller:

- General Cleanliness (76.83%): Maintaining high cleanliness standards is crucial for Dutch travellers, underscoring their focus on hygiene and sanitation during their travels.

- Safety Standards and Low Crime Rates (74.9%): Dutch travellers prioritize destinations with robust safety measures, reflecting their emphasis on personal security and peace of mind.

- Living New Experiences (73.28%): Embracing novelty and adventure is central to the Dutch travel ethos, showcasing their enthusiasm for exploring unfamiliar landscapes and cultural encounters.

- Price level in the country (71.6%): Affordability plays a significant role in Dutch travel decisions, highlighting their preference for destinations that offer value-driven experiences and competitive pricing.

- Health and Hygiene standards (68.62%): Ensuring optimal health and wellness provisions is essential for Dutch travellers, indicating their commitment to maintaining well-being while on the go.

The Dutch Traveller Behaviour Analysis

In analysing the behaviour of Dutch travellers, it's evident that they exhibit distinct preferences and tendencies in their travel choices. When it comes to booking, a significant majority (73.8%) prefer the flexibility of arranging accommodation and transportation separately, often opting for direct bookings through providers' websites. This inclination reflects a desire for personalised travel experiences and direct engagement with service providers.

It is worth noting that this behaviour varies depending on the trip destination. For domestic or within-Europe trips, the previously mentioned separate booking style remains prevalent. However, for international travel outside Europe, Dutch travellers tend to prefer the convenience of package trips that bundle flights and accommodation, streamlining the booking process. 45% of Dutch travellers said they have used this type of booking in the past.

“Representing destinations from all over the world, it is imperative for us to continuously develop our market knowledge and stay up to date on the latest insights to best serve our clients. One of these insights concerns the evolving landscape of Dutch travel, which reveals a fascinating trend towards personalised and flexible travel arrangements. This leaning towards customization underscores the Dutch desire for unique, self-curated travel experiences; an interesting notion that we are actively catering to. The development brings endless opportunities; especially in combination with the Dutch’ tech-savvy focus and desire for orientation through online platforms. With data and market information at the base of everything, we at USP Marketing PR aim to tell the hidden stories, highlight those unexpected experiences, and create awareness in order to inspire Dutch travellers to go on that long-desired journey” commented Anne Houwers, Head of Destination Marketing for USP Marketing PR..

In terms of accommodation preferences, 3 or 4-star hotels emerge as the top choice with 56.2% of respondents, highlighting a preference for comfortable yet reasonably priced lodging options. Holiday homes also garner popularity among Dutch travellers (55% of the respondents), indicating a penchant for homely and immersive accommodation experiences.

As for holiday types, Dutch travellers primarily seek relaxing trips, with 76.6% of respondents favouring this type of travel. "Sun and Beach Holidays" are also highly popular, with 72.2% of respondents choosing this option. "Visiting Friends and Family" remains a significant choice, preferred by 55.8% of Dutch travellers. This preference for relaxing and beach holidays highlights the Dutch inclination towards leisurely and enjoyable travel experiences.

“As we look to the future, the Dutch travel landscape shines brightly with promise. These latest insights into Dutch travel behaviour reveal a dynamic and adventurous spirit that continues to grow stronger. With rising household incomes and a pronounced enthusiasm for cultural, culinary, and unique local experiences, the Dutch travellers are set to explore the world with an even greater zest. This evolution presents unparalleled opportunities for our tourism partners to innovate and cater to these inspired adventurers” commented Mijke De Jong, Managing Director of Interface Tourism for the Netherlands.

“At Interface Tourism Netherlands, we specialise in connecting destinations with the Dutch audience. Together with our clients we can foster deeper connections, create unforgettable memories, and ensure that Dutch travellers experience the very best that global destinations have to offer”, she added.

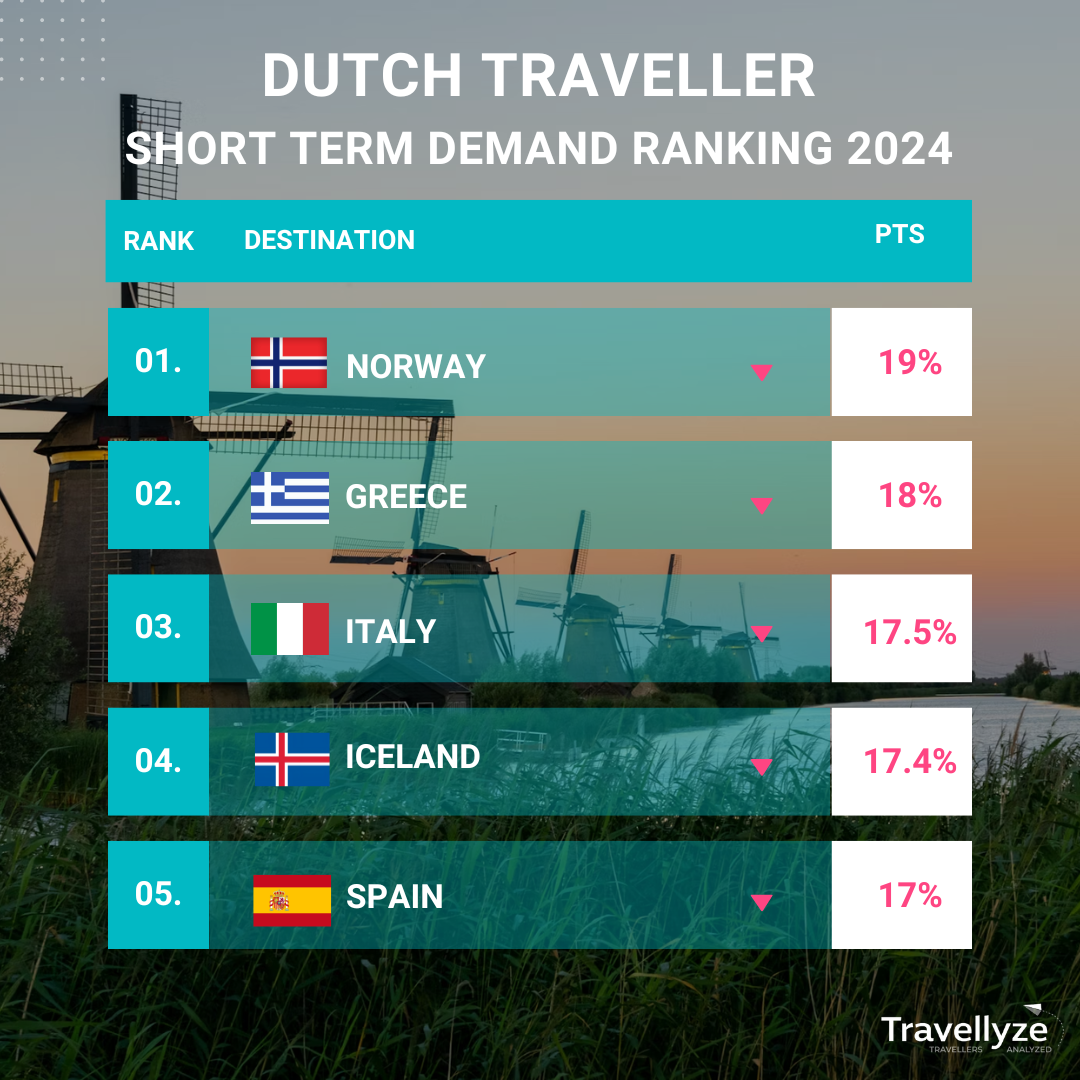

These are the top 5 destinations on the Short-Term Demand Ranking for Active Travellers in 2024

As we conclude our exploration into the world of Dutch travellers, we invite you to stay updated on the latest insights and trends in the tourism industry. Follow us on LinkedIn for exclusive access to in-depth analyses, cutting-edge research, and actionable strategies to navigate the ever-evolving landscape of travel and hospitality.