There are a multitude of ways you can define the luxury traveller. Indeed, various professionals featured on “a luxury travel blog” allude to an increasing desire amongst this cohort for exclusivity, and memorable experiences not normally available to the general public. As Steve Allen of Wexas Tailor-made Travel states, whilst “mode of travel and type of accommodation used can vary from a 5-star hotel or a boutique property to a unique building or an eco-style lodge”, ultimately, “the common theme is that the experience is a special one”.

Underpinning these preferences however is the pre-requisite of an upfront cost to these experiences only available to those on the highest budgets. Following this understanding of the luxury traveller, Travellyze features several variables that grant suitable insights into their profile. Amongst our European markets, we selected those who have an annual household holiday budget of over €10,000. The understanding of what denotes a luxury budget varies country to country, shaped by their relative economic realities. However, our figure reflects a broad average across our European markets. Thus, the following statistics provide a basis from which we can understand the luxury traveller to fuel your data-driven marketing strategies:

Key Demographic Info:

These travellers make up just under 3% of the adult population of our selected markets (the equivalent of 9,873,700 people. The average luxury traveller is mostly male, making up 6/10 of this demographic. They are mostly between 25-34 years old (22%), and as opposed to the average European norm, most have a master’s degree or similar or above (33%), closely followed by those who received a bachelor’s degree or similar (32%). The vast majority are married or live with a partner (56%).

It should be emphasised however that large differences prevail amongst our European markets. For example, in the UK, we note a 50/50 split between men and women travellers on luxury budgets. Our European results ae skewed however by mass inequalities in markets such as Spain, where 72% of high earners are composed by men. Non-binary representation amongst this cohort is also non-existent in these markets. This gulf in differences between our markets is a common theme (also seen in the ages of these travellers) and thus it should be stressed that whilst our search looked at the average of all our European markets, gulfs in the break down of our results do exist.

Travel Inspirations:

As with the average European, friends and family feature as their primary source of inspiration. Changing from this norm however is the importance of Travel TV programmes (36%), the second most important source, when compared to the general European, making up the 5th most important source. Of further note is the importance of social media channels, especially Instagram and Facebook, making up the third and fifth most important sources (garnering 35% and 32% respectively). Indeed, online sources are particularly important, with search engines such as Google and Bing (33%) and online reviews sites (29%) completing the top six list.

Covid-19: Continuing to influence travel factors

Further reflecting the European norm, the Covid-19 pandemic has greatly influenced the factors that go into the luxury traveller’s destination choice. Cleanliness (39%), and health and hygiene standards (37%) make up the first and third most important factors, all factors that we have seen sharp increases in in the aftermath of the onset of the virus. A further trend of note however is the ability to live new experiences, seeing a rise to 37% this year from 21% in 2020. This is a largely reported trend across many profiles in the aftermath of the pandemic, with many tourists and travellers seeking new experiences after being forced to stay in their homes for large periods of time as a result of lockdown measures. As mentioned earlier, luxury travellers are consistently looking for new, exclusive experiences, further reinforcing this trend.

How do they book their trips?

Most luxury travellers opt to book separate flights and hotels online via different booking portals/ travel agencies (39%), followed by booking package trips online with travel agencies and booking package trips with a travel agent in person or via phone/email (both on slightly over 3/10). This last channel is of particular note, making up just under double the percentage of the general European traveller. This may be explained by the propensity of luxury, tailor made travel agencies that cater to every want and desire available with the higher spending parity this demographic offers. When booking large trips, they also offer greater ease and simplicity so it should not be particularly surprising how much more popular they are with luxury travellers.

Sun and beach holidays: Their preferred holiday type

Slightly over half of luxury travellers prefer sun and beach holidays as their favourite type of holiday. This reflects the European norm, as does the popularity of relaxing holidays (where one can unwind and get into a lower gear), with 4/10 of respondents preferring this form of holiday. Big city holidays are also highly popular, with 33% of luxury travellers opting for this choice. Considering the high costs of many of the world leading capitals of the world, and their luxury offering, it is easy to see their attraction to this cohort of traveller.

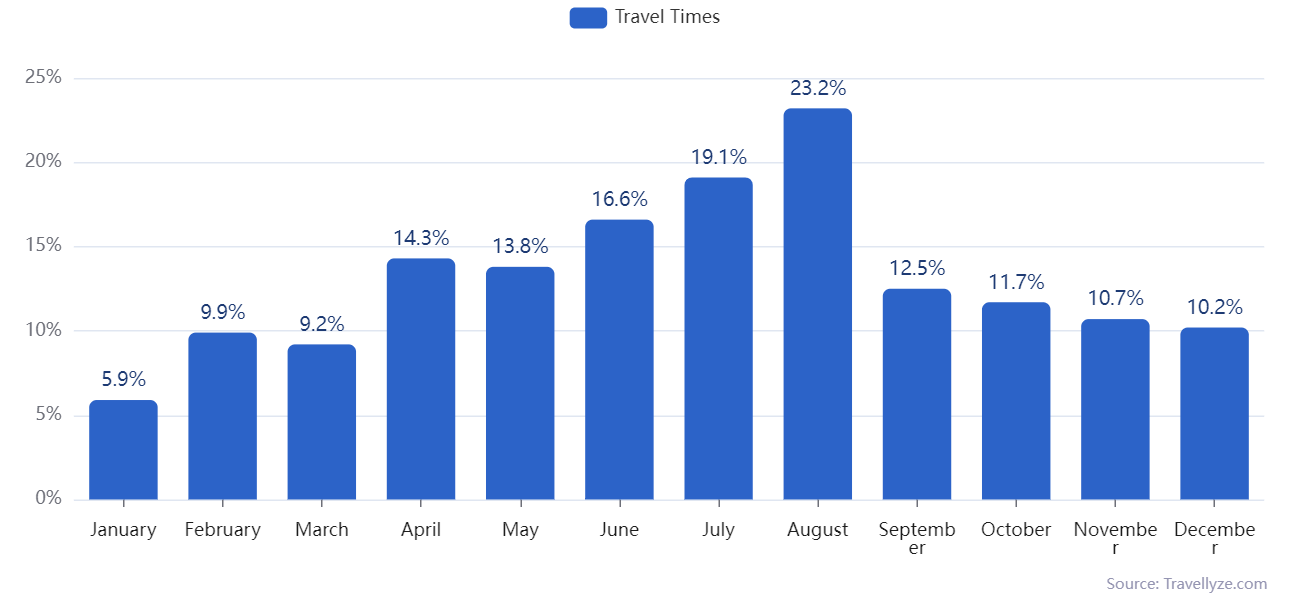

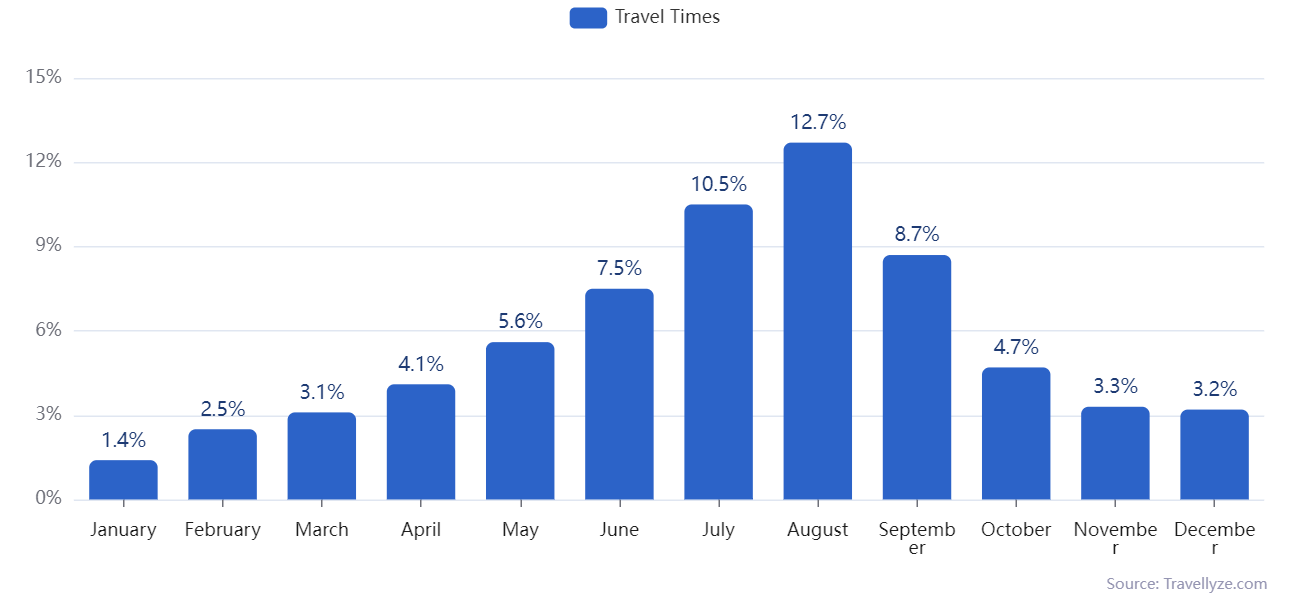

When do they travel?

Travellyze allows the user to find the most popular travel times depending on length of stay and destination. When we look at those who opt for international long holidays (of 5 days or more), we note that they mostly prefer August, followed by July and June. What is most striking however is the difference with the general European traveller. Below you can see the visible difference between both cohorts for this time and destination. We can see that not only does the luxury traveller have higher percentages across all months (as a result of having more disposable income to go on more trips), but we also don’t see as sharp a drop off in the further seasons from Summer. Luxury travellers have greater manoeuvrability at the time of travelling and are not as restricted to certain time periods to go on holiday.

Italy – The highest rated destination

On Travellyze, we offer an image ranking based on a comprehensive algorithm with three dimensions as points of reference: perception, experience, and awareness. These metrics are analysed separately to create the overall image of each destination. In the case of the European luxury traveller, their best placed destination is Italy, followed by Spain and the USA. The first two destinations, whilst offering spectacular luxury products in the shape of deluxe hotels and yachting experiences, reflect the importance of these destinations amongst many other cohorts of travellers, including the general European traveller. Indeed, this suggests that both destinations offer a fantastic range of tourism offer to suit all tastes and budgets.

On the other hand, the USA is the 21st highest ranked destination in this index for the general European traveller, a significant difference of 18 places when compared to the luxury traveller. The United States offers a great luxury product and represents a significantly more of an expensive destination. This is due to increased travel costs to reach the destination, unfavourable exchange rates for the European traveller (especially at the present moment) and generally more expensive rates in its most popular touristic cities and destinations when compared to cheaper European destinations. Thus, the USA is far more accessible and attractive to those on larger budgets.